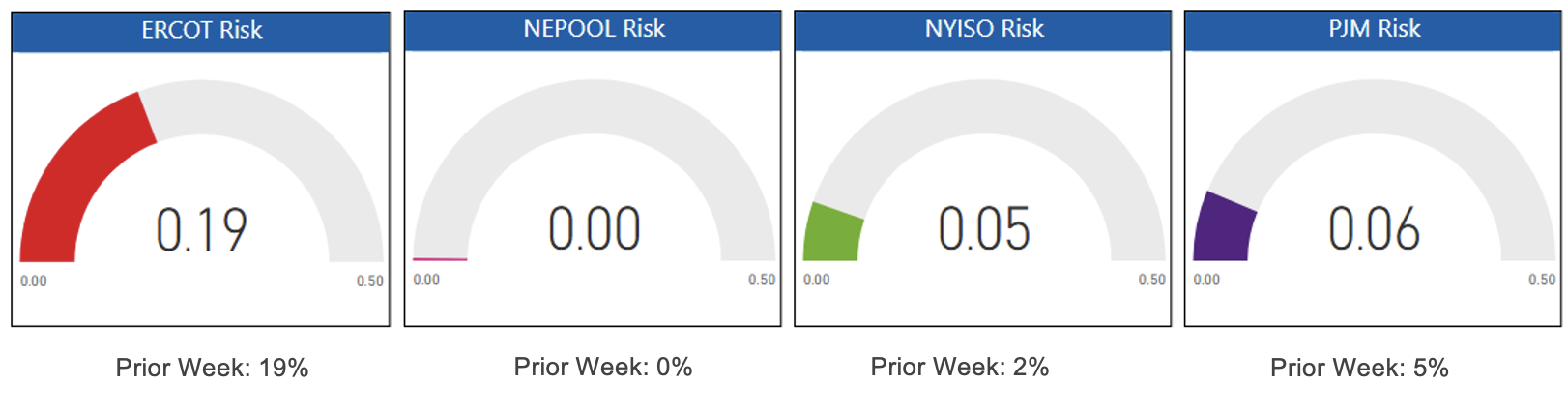

NEPOOL No Risk Again

Not much changed week-over-week as buyers and brokers in NEPOOL continued their rare preference for pricing requests with fixed prices and no market-based risk. NYISO market participants made a small move in the direction of index and flex products, but ERCOT continues to have the most interest.

Risk Appetite Report 01/27/25 – 01/31/25

The risk appetite gauges above reflect the mix of fixed, flex, and index volume priced in the period for customers with peak demand above 750 KW.